Motilal Oswal Review 2024:

Pros

- One of the established brokerage house of India

- MOSL research reports are widely acknowledged as best

- Free Account Opening & Zerp AMC for First year

- Good trading platforms and useful for all kind of traders

- Large number of franchise network

- Fund transfer facility with more than 60 banks

Cons

- Does not offer 3-in-1 demat account

- Brokerage is high in comparision with discount brokers

In this Motilal Oswal review, I will be bringing out more information about Motilal Oswal, a popular stock broker of India and their brokerage structure.

About Motilal Oswal:

Motilal Oswal Securities Limited (MOSL), a full service brokerage house was founded by Mr. Ramdeo Agarwal in 1987 and as you can understand they have more than 30 years of existence.

Based out of Mumbai, they offer services across multiple segments. They have diversified client based ranging from retail customers, High Networth Investors (HNIs), Institutional Investors and corporate clients.

Recently they also started dealing with Mutual funds after getting approval from SEBI.

Other segments in which MOSL offers services are:

- Equities

- Derivatives (F&O)

- Currency

- Commodities

- IPO

- Investment Banking

- Private Wealth Management

MOSL has its presence in more than 2200 locations and thier customer base is more than 19 lakh. They have more than 70,000 crores in depository assets.

USP of Motilal Oswal:

MOSL invests significant amount of their profit, around 10% in research and analysis. They have dedicated team of analyst for midcaps and largecap stocks. The team consist of fundamental and technical analysts.

They periodically publish these reports and they are widely acknowledged in the brokerage and investment world as best.

Motilal Oswal Brokerage Charges:

The brokerage charges of Motilal Oswal is as follows.

Motilal Oswal Account Opening Charges:

- Trading Account Opening Charges : NiL

- Trading Account Annual Maintenance Charges : NIL

- Demat Account Opening Charges : NIL

- Demat Account Annual Maintenance Charges (AMC) : Rs 441

The AMC is charged from second year onwards and no charges for the first year.

Motilal Oswal Account Opening:

The fastest way to open demat account with MOSL is Online. The account can be opened completely in 15 minutes if your mobile no is linked with Aadhaar and you can start trading.

You just need to upload the scanned copies (you can take photo from your mobile) of following documents,

- PAN Card

- Aadhhar card

- Passport Size Photo

- Photo of your signature done on a white paper

- Cancelled cheque/passbook (Required only if you wish to trade in Futures & Options Segments)

You can use below button to go directly to MOSL account opening page. If you get stuck at any point due to any confusion, dont worry, just leave your contact information there and their sales team will reach out to you and help.

Motilal Oswal Trading Platforms:

MOSL Desktop Application:

It is the installbale software which can be downloaded from their website. It is best suited for the traders who require fast execution.

Some of the salient feature are:

- 1 second refresh rate

- Auto generation of buy and sell signal through trade guide

- Access to 30,000 research reports within the tool

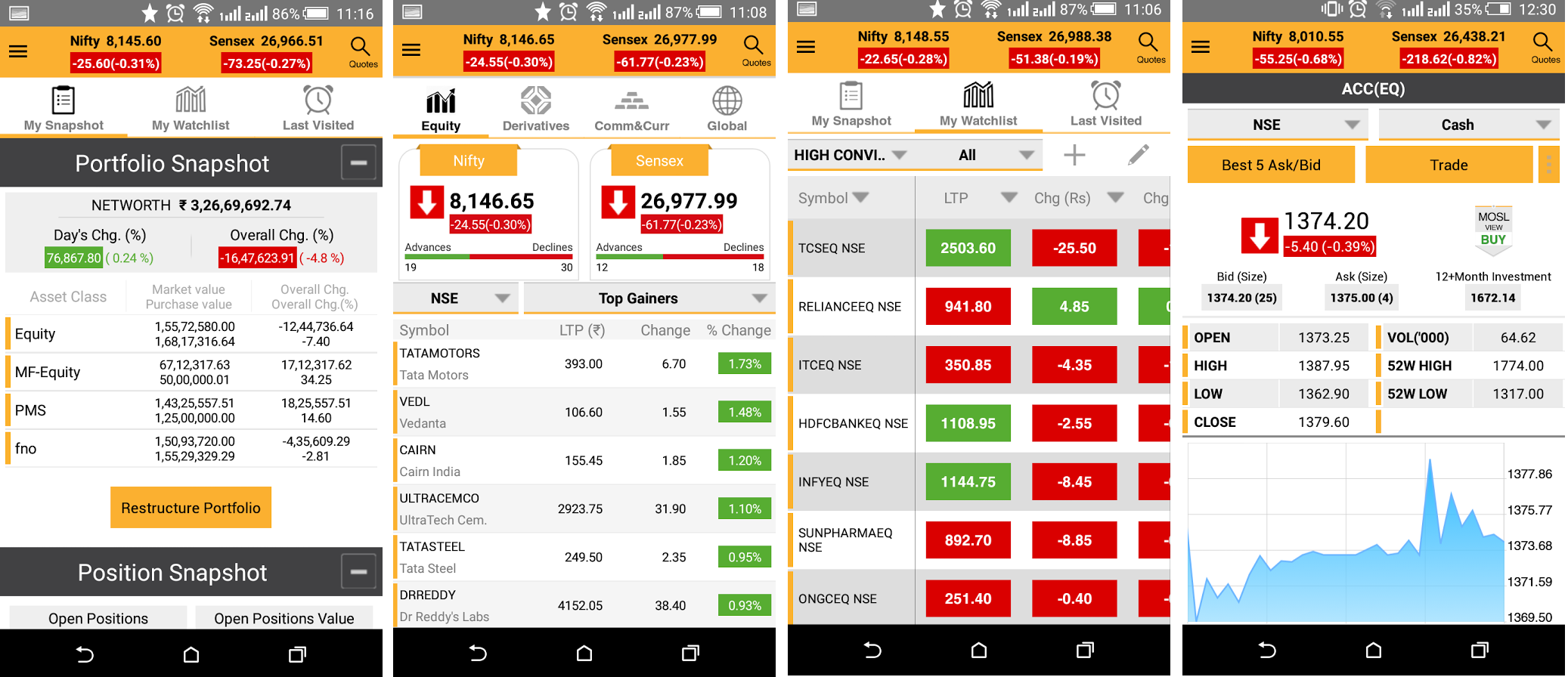

MOSL Mobile App:

Best suited for the users who frequently travel. One can access the market anywhere.

Some of the salient features of mobile app are

- Multi asset watch list with real time quotes

- Real time portfolio monitoring tools

- Secure mobile trading experience with one time login feature

- Funds transfer facility with more than 60 banks

MOSL Smart Watch App:

I cannot miss telling about this feature of Motila Oswal. They have introduced a different kind of user experience with MOSL smart watch.

One can wear this watch and get instant notifications.

Some of the features are,

- Instant information on global indices, market top gainers and losers

- Access to portfolio across asset classes

- Position updates

- Check margin in both cash and commodities segment

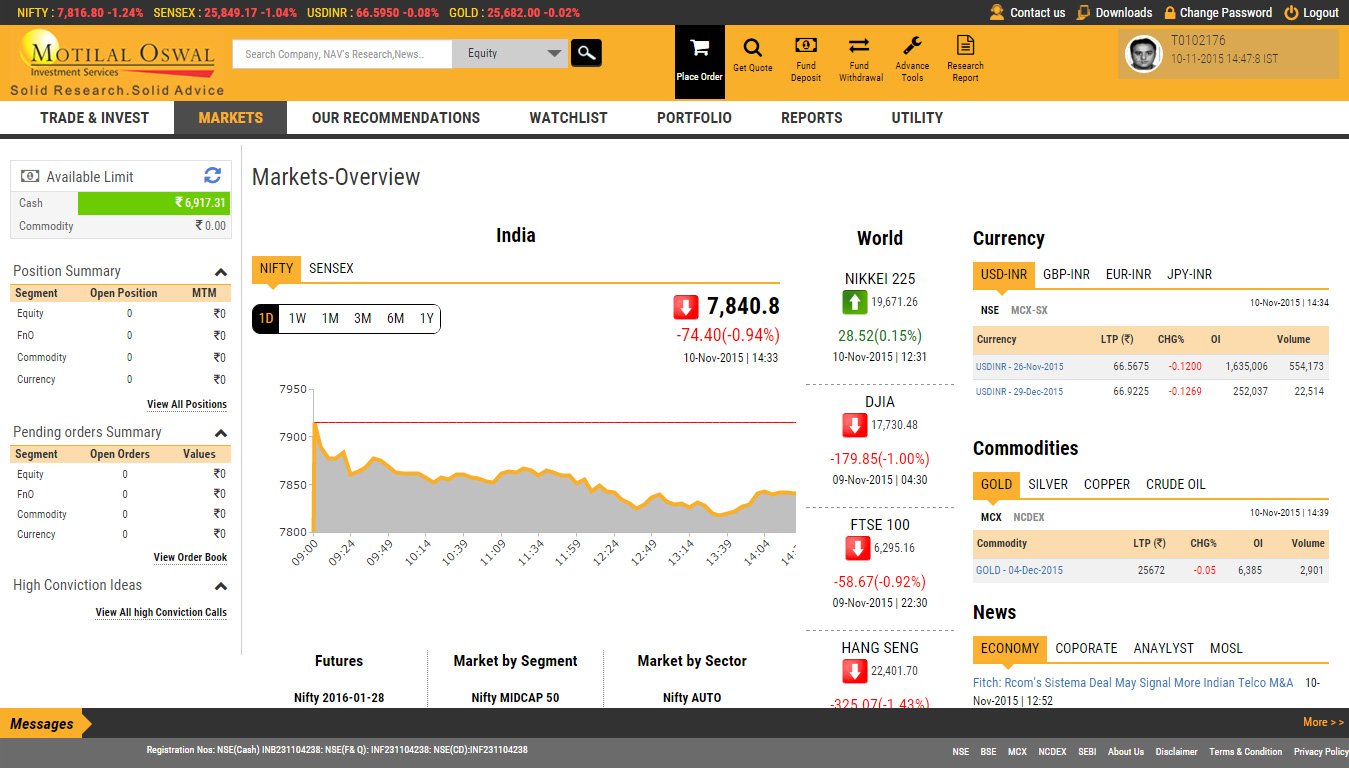

MOSL Trade:

It is a browser based trading platform. No need to install any application and can be accessed from anywhere with good internet connection.

Motilal Oswal Pros and Cons:

Disadvantages:

- Many complaints around hidden charges which are not explained by sales person during account opening

- Stocks recommendation are not up to the mark.

Advantages:

- Good trading platforms and useful for all kind of traders

- One of the established brokerage house of India

- Large number of franchise network

- Fund transfer facility with more than 60 banks

Motilal Oswal Review- Final Thoughts:

Motilal Oswal claims that they spend large amount of their profit on research and recommendation. But honestly I did not find them that useful.

I found their trading platforms are good and smartwatch app is one added advantage.

we don’t find too many branch offices like that of Sharekhan, but their franchises are spread across India.

If you decide to open account with them, make sure you understand the brokerage structure properly

You May be Also Intereseted In :